The term ‘cheap’ is relative - what one person considers cheap, might be expensive for another and vice versa. In this context, the cheapest health insurance would be the one you can easily buy for yourself, meaning it takes an affordable portion of your total earnings. Let us understand this by example - suppose you earn Rs 20,000 per month. Out of that, you can pay a monthly instalment of up to Rs 2,000, which comes to a ratio of 1/10. But if you earn Rs 10,000 per month and have to pay Rs 2,000 to the insurance company, then the ratio will be 1/5. This high a percentage of your earnings may affect your pocket substantially.

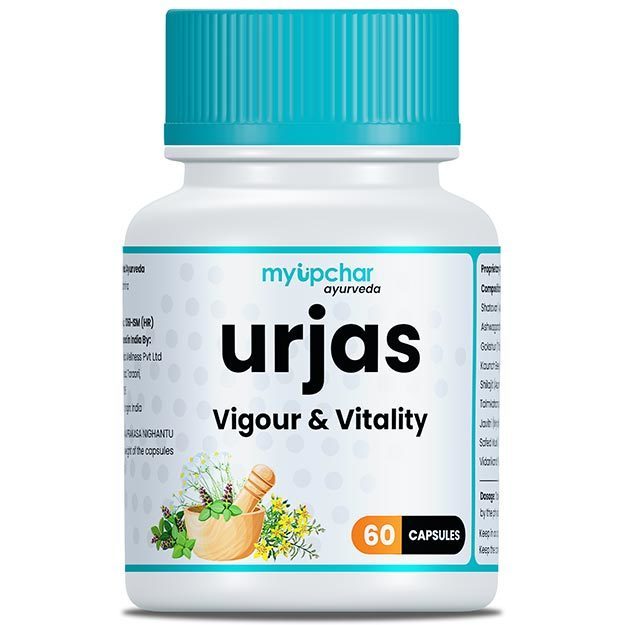

Affordable means only and only that amount, which you can easily manage without any stress and after taking that amount out, the rest of your expenses will not be affected much. For myUpchar Bima Plus Health Insurance of 3 lakh sum-insured, you have to pay a premium as low as Rs 6,541 per annum. It is very difficult to get any health plan at such a low premium. In this article, you’ll find information related to cheap health insurance that will not only help you in choosing the best policy for you but will also help you find one that doesn’t upset your budget.